Recovering unpaid expenses from clients is an unpleasant but vital part of a company’s operation, and if you are in need of legal assistance, our Miami, FL business collections lawyer is here to help you. Let customer debts grow too much, and you may not have enough working capital to fulfill new orders. Worse yet, you could go out of business. Many business owners, especially small business owners who are trying to grow a customer base, may not want to alienate customers by being aggressive with debt collections. Contact our team at Perez Mayoral, P.A. today to schedule your consultation.

Table of Contents

In many cases, intervention from our Miami, FL, business collections lawyer can result in a better outcome than the business owner can achieve on their own. The team at Perez Mayoral, P.A. has a reputation for professionalism and dignity in the business collections process. We help you preserve your client relationships and seek alternative resolution for outstanding debt.

Comprehensive Business Collections Services

Our attorneys work with businesses of all sizes, from single owner-operators to larger enterprises with multiple locations. Our clients include commercial loans and commercial lending companies, bank debt and other obligations, other financial institutions, commercial creditors, equipment leasing contractors, insurance agencies, contractors and tradesmen, commercial property owners, landlords, and more.

We provide bespoke commercial debt collections services, evaluating each account to determine the range of your exposure. We strive to resolve each case by providing our clients with plenty of information and suggestions for steps to take to recover the money owed and possibly preserve the business relationship.

Some of the remedies we may employ in your situation may include wage garnishments or repossession, bank garnishments, security interests or liens, or post-judgment remedies.

How Our Business Collections Lawyer Can Help You

A business owner may wish to have our professional Miami business collections lawyer handle recouping outstanding debts for many reasons. Firstly, having the third party negotiate debt repayment provides a layer between you and your customer – a “good cop, bad cop” scenario.

We also know that time is money. You may have plenty of other obligations for your business and not have the time to chase down debts. If you’re expanding, you may have multiple outstanding debts. You could be spending more time chasing down “old money” to make new money and solicit new customers!

A skilled business collections attorney can send a demand letter to the party or parties that owe outstanding debts. We contact them, explain the nature of the debt, and propose a timeline for repayment. If our initial attempts at bringing debtor accounts current are unsuccessful, then we escalate legal activity. This could include filing a lien or even bringing the case to court. A judge may approve additional lien findings, garnishment, repossession, or other legal remedies.

Business Credit Management

With all that running a business entails, managing accounts receivable and ensuring timely collections can often be a formidable challenge. This is where the experience of our Miami, FL business collections lawyer becomes indispensable. Our attorneys possess a unique blend of legal knowledge and practical experience, enabling them to work through the complexities of business credit management effectively. If you’re in need of guidance for your business, don’t hesitate to contact Perez Mayoral, P.A. with any questions you may have.

How An Attorney Can Help With Collections

The primary responsibility of a business collections lawyer is to assist companies in recovering debts in a manner that is both efficient and compliant with existing laws. They employ a comprehensive approach that encompasses everything from drafting initial demand letters to, if necessary, representing the company in court. Their experience not only lies in understanding the legal framework surrounding debt collection but also in strategizing the most effective methods to recover outstanding payments.

One of the key advantages of working with a lawyer is their ability to customize collection strategies to fit the specific needs and circumstances of each business. This personalized approach allows for recovering debts while in a respectful and professional manner, maintaining the company’s reputation and safeguarding its financial interests.

The Benefits Of Professional Legal Assistance In Collections

Legal professionals are knowledgeable about the legal risks associated with debt collection, ensuring that the company’s practices are in full compliance with laws like the Fair Debt Collection Practices Act. This not only reduces the risk of legal liabilities but also protects the company from potential reputational damage.

With our extensive experience, we can significantly expedite the debt recovery process. An attorney’s understanding of the legal system and negotiation skills can lead to quicker settlements, improving the company’s cash flow and reducing the time spent on chasing unpaid accounts.

In instances where debt recovery efforts escalate to litigation, having a legal expert on your side is invaluable. They can provide robust representation in court, leveraging their legal acumen to advocate for the company’s interests.

Beyond just collections, an experienced business collections lawyer can offer strategic advice on credit management policies and practices. This can include recommendations on credit applications, terms of trade, and proactive measures to minimize future bad debts.

Enhancing Your Business Financial Health

For businesses facing challenges with overdue accounts, the support of a legal professional specializing in collections can be a game-changer. Not only can they assist in recovering outstanding debts, but they can also provide guidance on improving overall credit management strategies. This dual approach not only addresses immediate financial concerns but also lays the groundwork for more robust financial health in the long term.

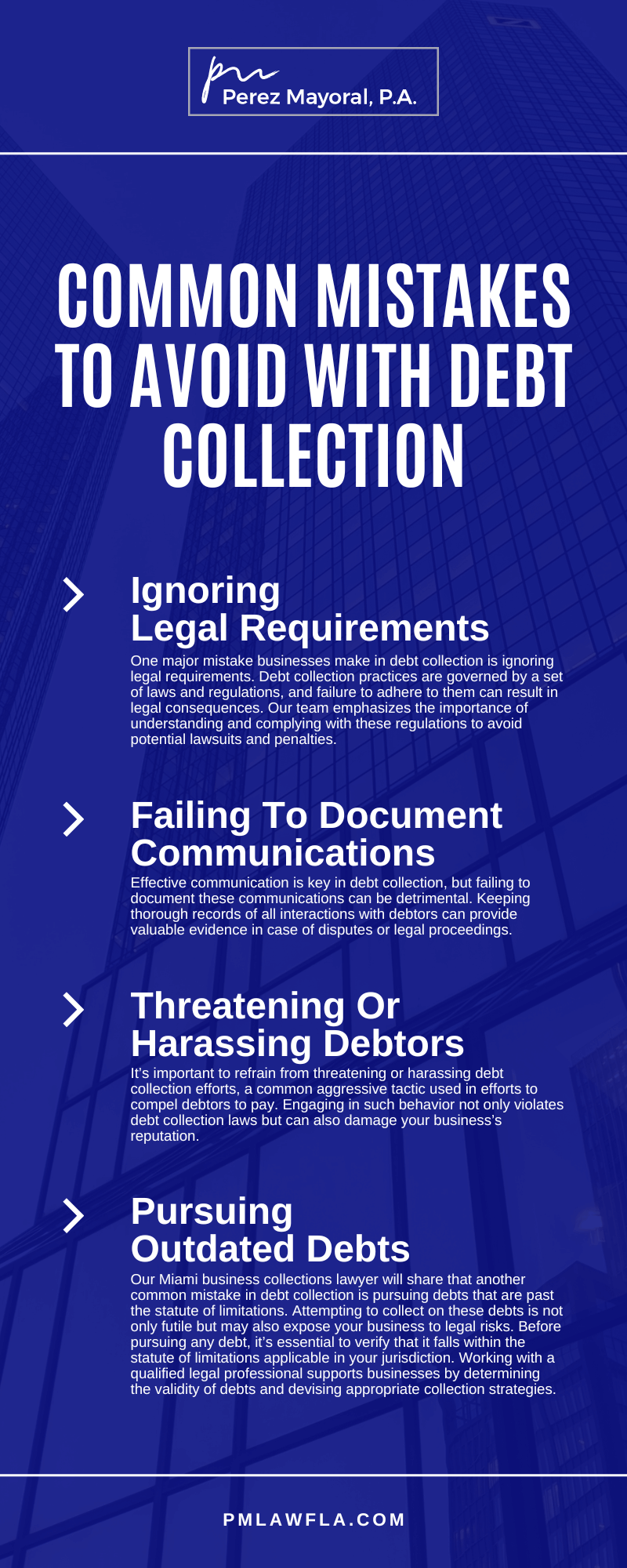

Common Mistakes To Avoid With Debt Collection

Our Miami, FL business collections lawyer knows there are several complexities when it comes to dealing with debt collections. In the business world, debt collection can be a challenging and sometimes daunting task. However, by avoiding common mistakes, you can streamline the process and increase your chances of success. There are some common errors to steer clear of when dealing with debt collection. At Perez Mayoral, P.A., we understand debt collection law and are here to provide guidance and support to businesses when they need it the most.

- Ignoring Legal Requirements

One major mistake businesses make in debt collection is ignoring legal requirements. Debt collection practices are governed by a set of laws and regulations, and failure to adhere to them can result in legal consequences. Our team emphasizes the importance of understanding and complying with these regulations to avoid potential lawsuits and penalties.

- Failing To Document Communications

Effective communication is key in debt collection, but failing to document these communications can be detrimental. Keeping thorough records of all interactions with debtors can provide valuable evidence in case of disputes or legal proceedings. A legal professional will advise businesses to maintain detailed records of phone calls, emails, and letters exchanged during the collection process.

- Threatening Or Harassing Debtors

It’s important to refrain from threatening or harassing debt collection efforts, a common aggressive tactic used in efforts to compel debtors to pay. Engaging in such behavior not only violates debt collection laws but can also damage your business’s reputation. Working with an experienced legal team offers business owners with advocacy and professional and respectful communication when dealing with debtors, as it yields better results in the long run.

- Pursuing Outdated Debts

Our Miami business collections lawyer will share that another common mistake in debt collection is pursuing debts that are past the statute of limitations. Attempting to collect on these debts is not only futile but may also expose your business to legal risks. Before pursuing any debt, it’s essential to verify that it falls within the statute of limitations applicable in your jurisdiction. Working with a qualified legal professional supports businesses by determining the validity of debts and devising appropriate collection strategies.

Business Collections Infographic

Miami Business Collections Statistics

According to data from the Federal Judiciary, more than 18,000 companies file for bankruptcy each year, often leaving creditors unpaid. We recommend following up on unpaid balances consistently so as not to leave your business holding the bag. If you have clients with outstanding debts, call our office to find out how one of our business collections lawyers can help get you the money you are owed, before it’s too late.

Miami Business Collections FAQs

In the world of business, financial transactions often involve the occasional hiccup. When clients or customers fail to meet payment obligations, companies may need to resort to collection measures. However, navigating the legal landscape of debt collection can be complex and challenging. The following are some of the most common questions that clients who work with our Miami business collections lawyer ask. For more detailed information about your situation, contact Perez Mayoral, P.A.

What Regulations Govern Business Debt Collection?

Business debt collection is subject to various laws and regulations at both the federal and state levels. One of the primary federal statutes governing debt collection practices is the Fair Debt Collection Practices Act (FDCPA). This legislation prohibits abusive, deceptive, and unfair practices by debt collectors. It outlines guidelines regarding communication with debtors, disclosure of debt information, and the validation of debts.

Individual states may have their own set of regulations that businesses must adhere to when engaging in debt collection activities. In Florida, legal regulation of debt collection falls under the Florida Consumer Collection Practices Act (FCCPA). State regulations can vary widely, covering areas such as licensing requirements, interest rates, and permissible collection practices. This is why it is crucial for businesses to work with a Miami business collections lawyer to ensure they are abiding by all applicable laws.

What Are The Legal Implications Of Debt Collection Harassment?

Harassment or abusive conduct during debt collection efforts can lead to severe legal consequences for businesses. The FDCPA prohibits debt collectors from engaging in practices such as using threats or obscene language, making excessive phone calls, or disclosing a debtor’s information to third parties without authorization. Violations of the FDCPA can result in lawsuits brought by debtors, enforcement actions by regulatory agencies, and monetary penalties.

Businesses must ensure that their debt collection activities comply with the provisions of the FDCPA and other relevant laws to avoid potential legal liability. Establishing clear policies and procedures for debt collection, providing employee training on compliant practices, and maintaining accurate communication records with debtors are essential steps in mitigating the risk of harassment allegations.

What Are My Options For Recovering Unpaid Debts?

When faced with unpaid debts, businesses have several legal options for pursuing recovery. One common approach is to file a lawsuit against the debtor to obtain a judgment for the amount owed. Once a judgment is obtained, businesses can use various methods to enforce it, such as garnishing wages, placing liens on property, or seizing assets.

A business may choose to work with an attorney who specializes in debt collection to assist with the recovery process. A lawyer can leverage their expertise and resources to negotiate payment arrangements with debtors or pursue collection through legal means.

How Can Businesses Protect Themselves During Debt Collections?

Businesses should adopt proactive measures to ensure compliance with applicable laws and regulations and minimize the risk of legal challenges during debt collection. This includes maintaining accurate records of debts owed, clearly communicating with debtors regarding their obligations, and providing opportunities for debtors to dispute or validate debts.

Businesses should also stay informed about changes in debt collection laws and seek legal guidance to ensure their practices remain compliant. By taking a proactive and compliant approach to debt collection, businesses can minimize legal risks and protect their interests while seeking to recover unpaid debts.

Contact Our Miami Business Collections Lawyer Today

Managing legal issues in business debt collection requires a thorough understanding of applicable laws and regulations and proactive compliance measures. Make sure your company is protected by working with our skilled Miami business collections lawyer. Call Perez Mayoral, P.A. to find out how we can help your company legally and successfully collect the debt owed to you.